Question: I’m buying a home with a four foot hole in the roof with major fire damage. I’m getting a great price point because of the existing damage. Is there a way to buy the house and finance the cost of these major renovations into my mortgage. The answer of course is yes structuring the transaction using a Standard/Full FHA 203K. The Standard differs from the streamline in that repairs can be over the $35,000 streamline limit and you can complete structural and foundation repairs. The Standard 203K requires the homeowner hire a HUD consultant to create a specification of repairs.

Question: I’m buying a home with a four foot hole in the roof with major fire damage. I’m getting a great price point because of the existing damage. Is there a way to buy the house and finance the cost of these major renovations into my mortgage. The answer of course is yes structuring the transaction using a Standard/Full FHA 203K. The Standard differs from the streamline in that repairs can be over the $35,000 streamline limit and you can complete structural and foundation repairs. The Standard 203K requires the homeowner hire a HUD consultant to create a specification of repairs.

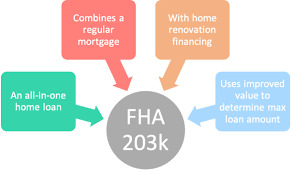

203K is still an FHA loan and all the FHA rules apply. You can purchase and renovate a one-to-four unit property using a 3.5% down payment based on the purchase price plus the renovation.

70% of homes in the country are forty years old or older. Many haven’t been upgraded over the years and are being sold at a reduced sales price because they need everything from a new roof, new kitchen, new bathrooms, and new flooring. Some need to be taken down to the studs replacing everything, or even torn down and rebuilt using the existing foundation. You may want to even add a second story to the existing structure.

I use the term “blank canvas” when talking about renovation projects. Using yours and your families imagination and energy you can paint whatever picture you’d like on your blank canvas. Make your new or existing home exactly the way you want it. Draw ideas from other homes you’ve been in or seen, home improvement magazines and websites, and there must be fifty renovation shows on HGTV. Create your dream and we’ll help you execute it.

Funding FHA 203K transactions is based on the after-improved value of the home where an appraiser having the purchase contract and the specification of repairs (construction and costs) gives an opinion of the after-improved value prior to the work being started. A regular FHA home loan has 3.5% down payment or a 96.5% loan to value. 203K is different in that FHA allows us to go all the way up to a 110% loan to value. An example would be if a property came back with an after-improved value of $200,000, the basis for the loan can go up to $220,000 X 96.5% or a loan amount of $212,300. This allows an additional $20,000 in construction available to complete the property without having to cut corners.

We are the renovation center for our entire six billion dollar company from Main to Maui. We’re approved to write home loans in all fifty states. Every renovation transaction goes through our local processing and underwriting department. Prior to originating a renovation transaction each originator has to go through our quick close training. Each file originated is reviewed buy our staff prior to disclosing the transaction. Then it’s processed and underwritten and closed by our in-house staff. With well over 100 years combined renovation experience our staff, using our quick close renovation system clears all renovation transactions in thirty days or less from application to closing.